|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding One Pet Insurance: Comprehensive Guide for Pet OwnersWhen it comes to protecting your furry friends, 'One Pet Insurance' offers a solution tailored to your needs. Whether you're a new pet owner or have been nurturing your companions for years, understanding the nuances of pet insurance is essential for making informed decisions. Why Consider One Pet Insurance?One Pet Insurance provides financial protection against unexpected veterinary expenses. With rising costs in pet healthcare, having insurance can be a lifesaver.

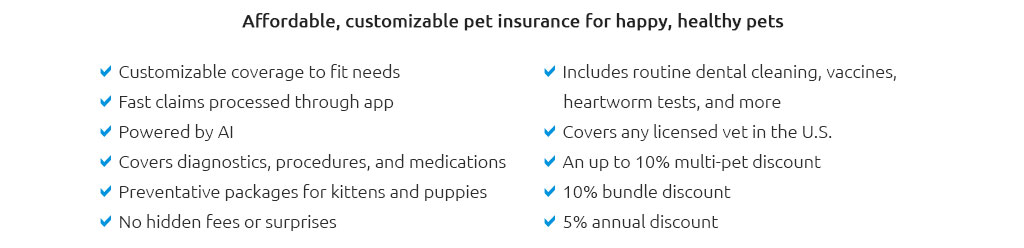

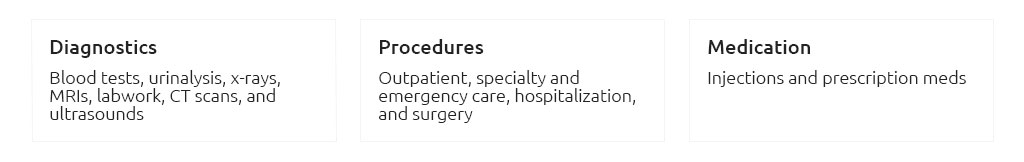

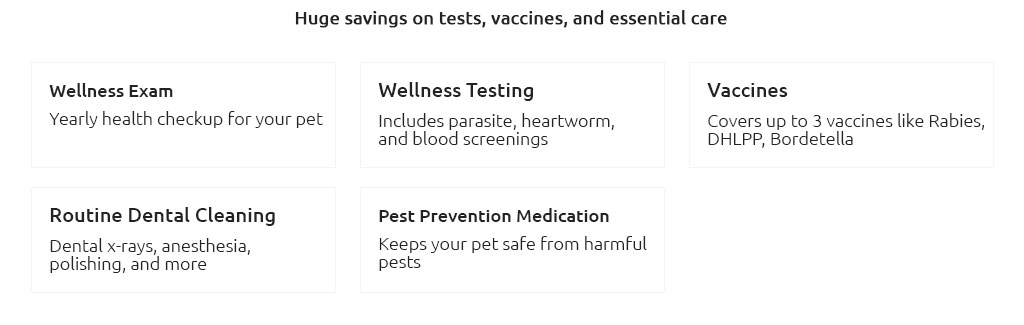

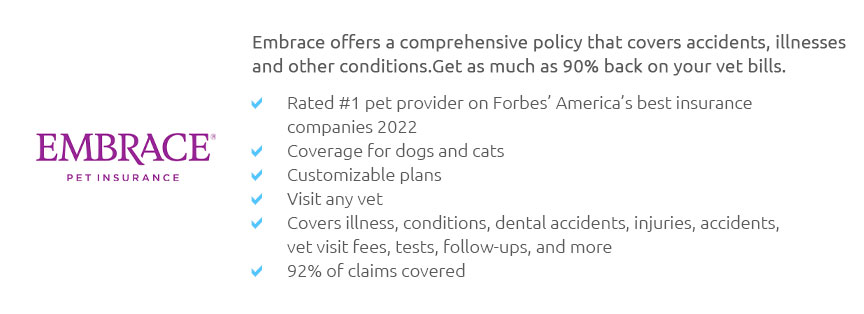

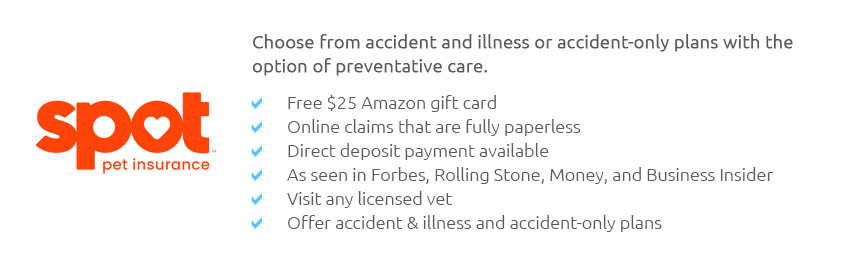

To understand more about the financial implications, check the pet insurance average costs which vary depending on the plan and provider. Types of Coverage AvailableAccident-Only PlansThis type of plan covers costs associated with injuries resulting from accidents such as broken bones or ingestion of foreign objects. Comprehensive PlansThese plans cover a wide range of issues, from accidents to illnesses and sometimes preventive care. Wellness Add-onsSome providers offer wellness packages that can be added to a basic plan, covering routine check-ups and vaccinations. Choosing the Right PlanWhen selecting a plan, consider the following factors:

For more localized options, explore pet insurance in Bellevue WA for plans specific to your area. Frequently Asked QuestionsWhat does one pet insurance typically cover?Most policies cover accidents and illnesses, but it's essential to read the terms to understand specific inclusions and exclusions. How do I file a claim?Filing a claim usually involves submitting a claim form along with veterinary receipts. Check with your provider for specific instructions. Is pet insurance worth the cost?Pet insurance can be worth it if you want to mitigate the risk of high veterinary bills, especially for breeds prone to health issues. https://www.oneplan.co.za/plans/PetPlans

Our affordable pet plans. Have you seen our online offer? Simply sign up online and SAVE 30% on your first two months' premiums. https://onegroup.com/personal-insurance/pet-insurance/

OneGroup provides insurance for your cats and dogs through PetPartners. By working with us, you will receive a 10% discount and can earn an additional 5% ...

|